Use Case: AI Weld Defect Detection on Automotive Production Lines

Executive Summary

An automotive manufacturer used AI and machine learning to automate weld quality inspection and NDT testing. Secure on-prem model evaluation using tracebloc achieved near-99 % defect detection in real time. The result: over €4 million in annual savings and higher production reliability.

Step 1: The Use Case

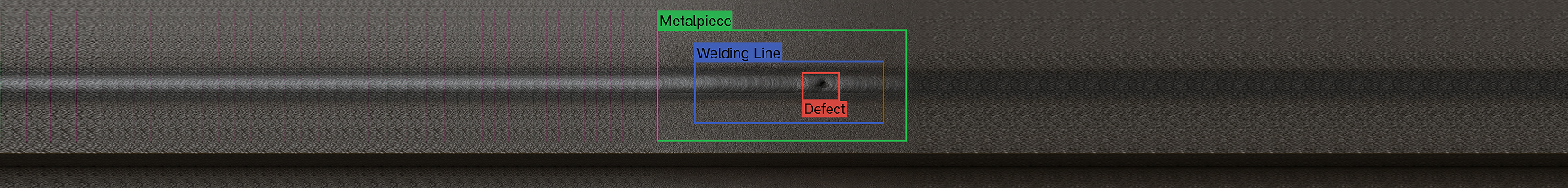

Weld quality is critical in EV manufacturing. Subtle defects can lead to rework, safety risks, or recalls.

Andreas Maier, Head of AI & Automation at a car manufacturer’s main production site, is tasked with improving the non destructive testing weld inspection (NDT) process. His goal is to automate weld quality inspection with AI and machine learning, reduce undetected defects, avoid costly rework, and maintain structural integrity standards in EV battery housings and chassis.

The manufacturer currently relies on rule-based visual NDT quality inspection systems that detect most surface defects but miss subtle internal flaws like micro cracks or porosity. As the car manufacturer scales its EV production, Andreas wants to overcome these limits. The team plans to implement AI-based surface defect detection and machine learning welding models capable of real-time, inline evaluation at full line speed.

Key requirements:

- The AI model must run on edge hardware (e.g. Jetson AGX Orin) directly on the welding line

- Must achieve ≥99% defect detection recall and a precision ≥95%

- Must operate in under 10 ms per weld image to alert in real time

The car manufacturer has access to a large labeled internal dataset. While building an internal system is feasible, Andreas also wants to tap into the market. He initiates an evaluation of external vendors offering the best pretrained CV weld inspection models.

Step 2: What the Vendors Claimed

Each vendor submitted technical and commercial offers:

Vendor

Model Architecture

Claimed Recall / Precision

Inference Latency per Image

A

DSF-YOLO

99,1% / 98,3%

3 ms

B

YOLOv8

99,3% / 99,0%

7 ms

C

FasterRCNN

98,8% / 99,2%

10 ms

While all vendors claimed high recall, the car manufacturer focused on false negative rates, inference latency, and model robustness to variations in weld types (e.g. spot, seam, laser welds across aluminum and steel).

Step 3: Secure Evaluation and Fine-Tuning

Using tracebloc, Andreas deployed isolated sandboxes on factory edge devices. Vendors were not given access to raw weld data. Instead, they fine-tuned models on-prem, securely and under supervision, without ever getting access to the data. This approach ensures IP protection and compliance with internal data governance policies.

Each vendor received:

· 500k images for training

· 50k for benchmark evaluation

· Metrics: Recall, precision, false negative rate, inference time

After baseline testing, vendors were allowed to fine-tune models.

Step 4: Observed Results After Testing

Vendor

Claimed Recall

Baseline Recall

Recall After Fine-Tuning

A

99,1%

94,0%

96,2%

B

99,3%

94,5%

98,3% ✅

C

98,8%

93,2%

97,9%

The model YOLOv8 by vendor B showed the strongest performance gain after secure fine-tuning on the car manufacturer’s real production data, outperforming other baseline metrics. None of the vendors reached 99%, however, the car manufacturer hopes to further improve the model through additional edge-case data and fine-tuning.

Step 5: Business Case – Cost of Missed Defects

Assumptions:

Annual production: 1 million vehicles

Welds per vehicle: ~6.000

Defect rate = 0,1%

Total welds/year: 6 billion i.e. 6 million weld defects

Manual system defect escape rate: 5% → 300.000 undetected defects/year

Cost per missed weld defect (rework, scrap, warranty, safety recall): €30

False alarm costs are considered negligible due to semi automated rework and equal precision of about >95% across all vendors

Missed defect costs dominate the total cost of ownership and drive vendor selection:

Strategy

Recall

Missed Defects

Missed Cost

Edge Device and initial Setup Cost

Total Annual Cost

Human + rule based

~95,0%

300.000

€9,0m

€0

€9,0m

Vendor A

96,2%

228.000

€6,8m

€1,2m

€8,0m

Vendor B ✅

98,3%

102.000

€3,1m

€1,5m

€4,6m

Vendor C

97,9%

126.000

€3,8m

€1,4m

€5,2m

Step 6: Decision – Full Inline AI Deployment with Vendor B

Vendor B’s YOLOv8 model outperformed DSF-YOLO and FasterRCNN after secure fine-tuning, achieving almost 99% recall at sub-10 ms latency per image on edge. This is not yet up to the required standard, but after more labeling and re-training on edge cases, Andreas hopes to further improve and achieve the desired performance. So the car manufacturer decides to select Vendor B for inline weld inspection at full takt time.

Estimated annual savings: over €4m plus improved product quality & traceability.

Disclaimer:

The persona, figures, performance metrics, and financial assumptions in this case study are fictional and simplified to reflect realistic industry logic. This case is designed to illustrate AI benchmarking and does not reflect actual vendor performance or contractual outcomes.